How To File KRA Returns 2022. Step-by-Step. With Photos

- How to file tax return 2022

- how to file paye tax

- how to file tax returns

- how to file nil returns

How to file KRA returns 2022. Filing KRA Tax returns for employees has never been easy. Paye in Kenya is filed every year before the 30th of June. This is done for both residential and non-residential. The unemployed netizens are required to file a nill return. Failure to this the taxman imposes a penalty of Ksh 2000 for unemployed Kenyans and Ksh 20,000 for the employed. The task for Citizens is just filing their tax since their monthly pay as you earn (PAYE) is deducted prior to the filing period. The tax is deducted directly from their employees. There are so many different types of Tax returns but in this article, we will just cover Income Tax PAYE.

What you are required to have.

1. Registered and have a valid KRA PIN. every employed Kenyan MUST have one

2. Access to your Online KRA portal.

3. P.9 form (provided by your employer)

4. Access to the internet and a computer ( you can’t file from your photo)

Step by Step. How To File KRA Returns

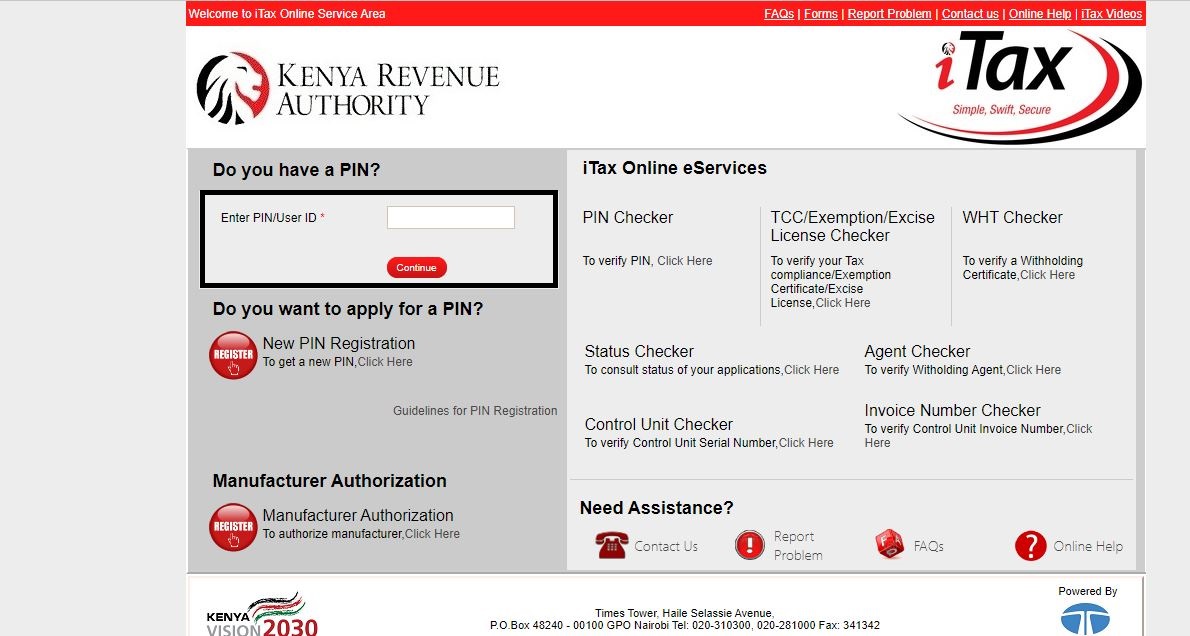

1. log in to KRA Itax Portal here

You will first need to log in to your Kra itax portal here. use your KRA PIN to log in and password as shown below. In case you can’t recall your last KRA PIN password you can use the reset button. your password will be sent to the email address you used to register. You will then be prompted to change your password after login. Follow the steps provided.

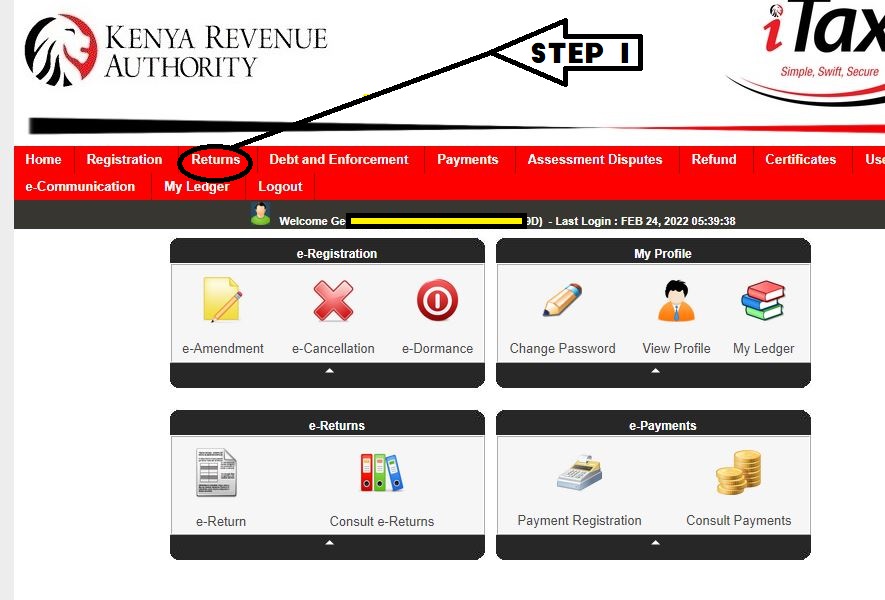

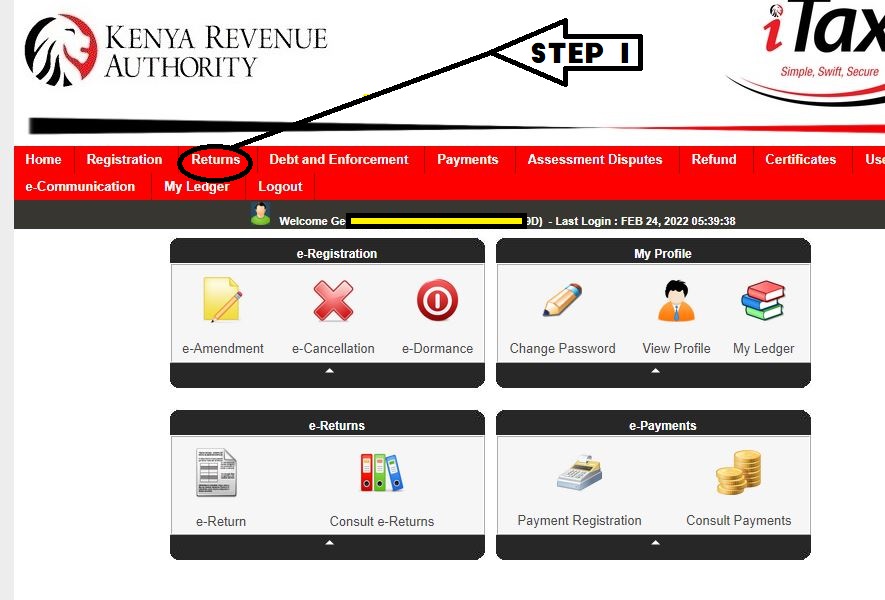

2. Click the Returns Button.

The second step is to click the Return tab and select File return for Employees or File nill return for unemployed as shown below in the diagram.

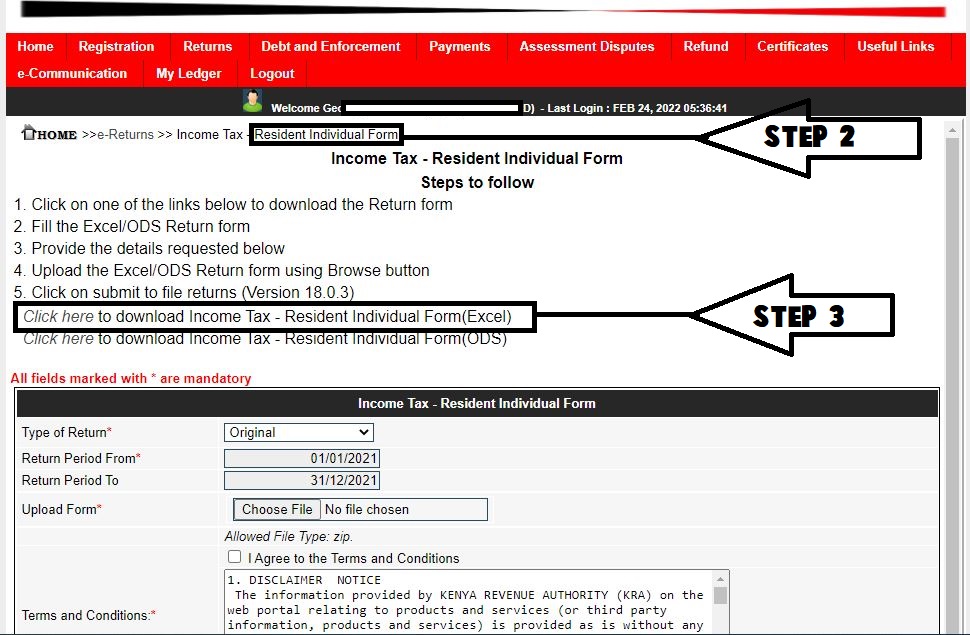

3. Download the KRA Excel document and open it on your computer

using Microsoft Excel or any other Excel sheet Software. In our case, we used Microsoft Excel. Please note it may take time to open.

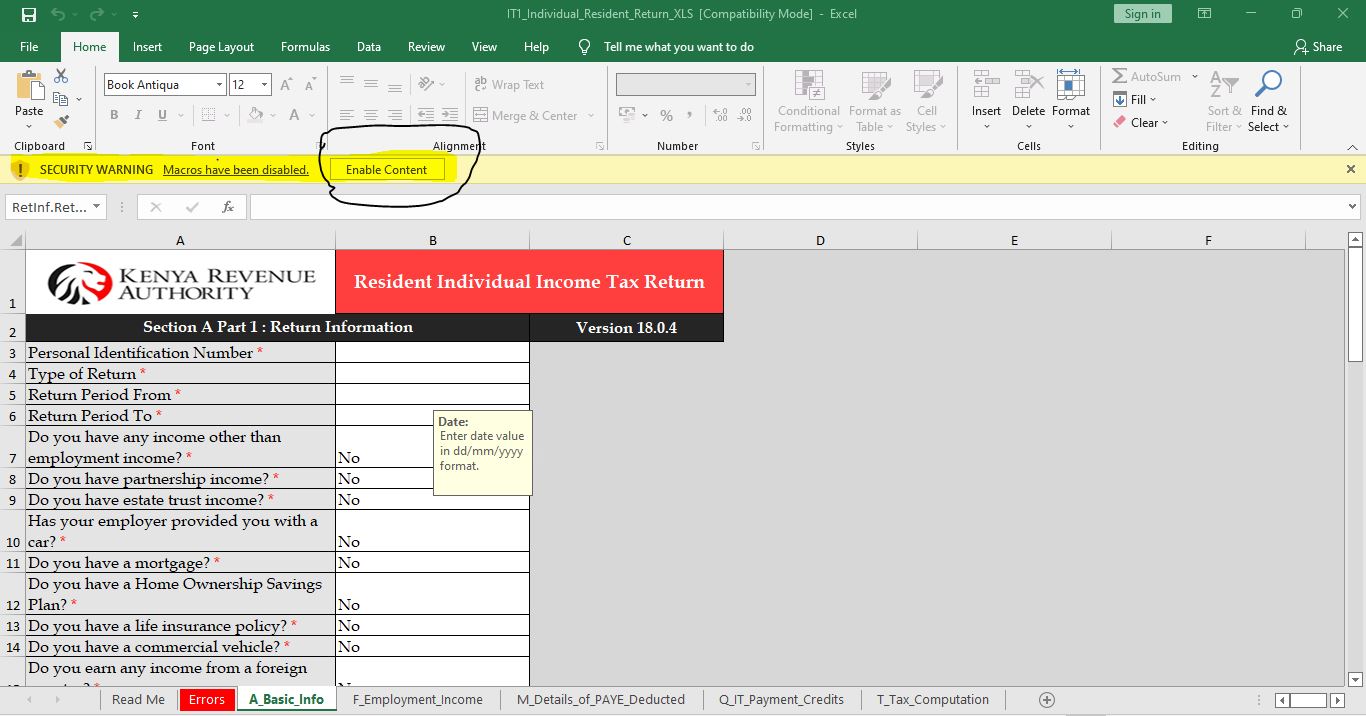

4. Enable Macros on top of your screen

in order to edit the document as shown below. Remember you should not use copy and paste in this document. Editing Excel documents takes time so be patient.

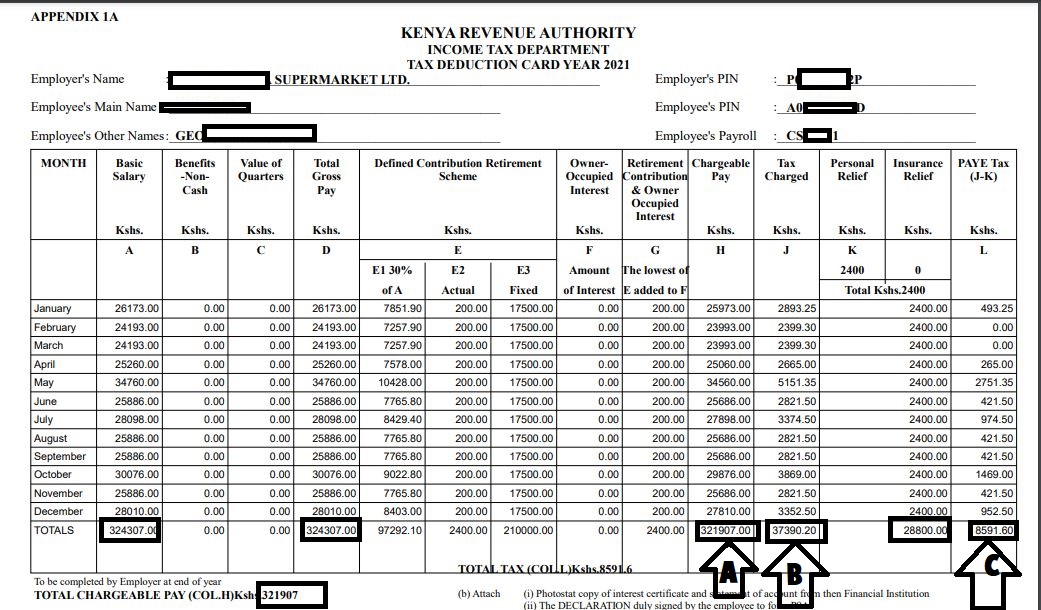

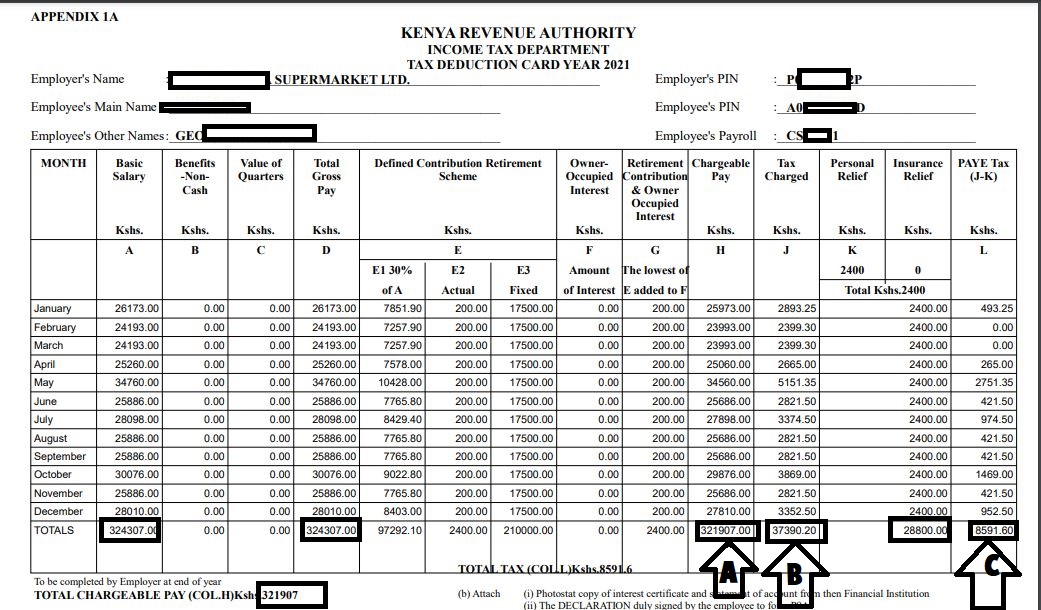

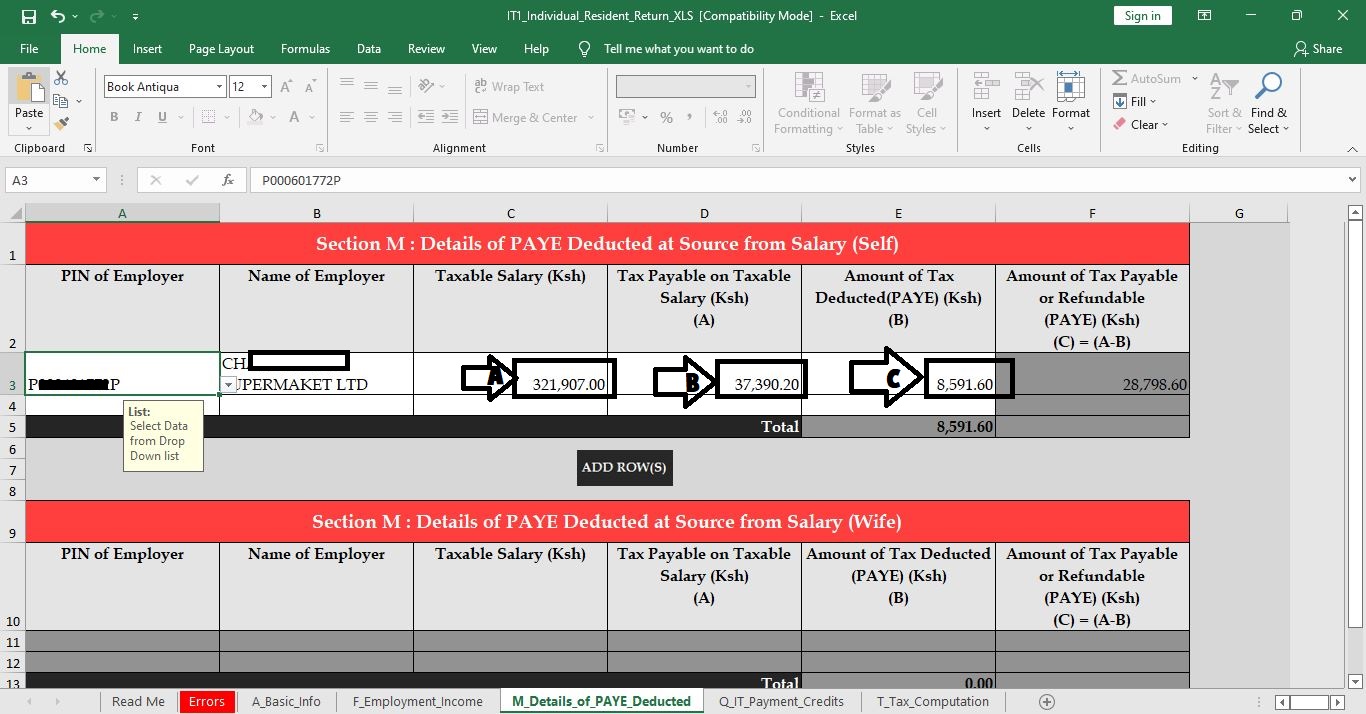

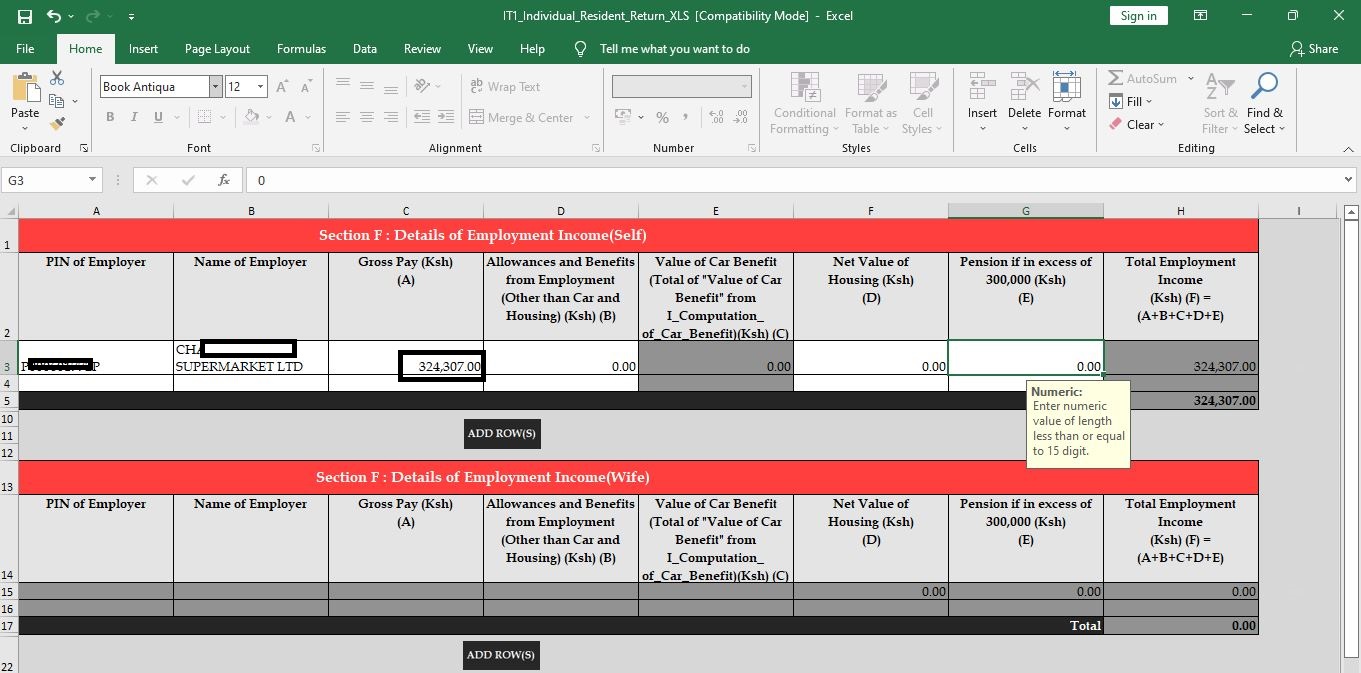

5. Fill your document with details provided on your P.9 Form.

the style and column in your P.9 form may differ. The document column named with Alphabetic letters in most cases doesn’t match those on the Kra Excel document. You are therefore required to read and check the figures if they match the document columns. In the illustration picture provided, we have named the figures you need to check in your form. Remember the figure might be different.

P.9 Tax Form Explained

a. Gross pay- as indicated in your form and our form below is the total earnings before deductions

b. Chargeable pay- this is the salary paid deducted retirement contribution. (A) this is the amount you will fill in your Excel document.

c. Tax Charged- this is the total tax that you have been charged the whole year (B) you should fill these figures in your form. Filling incorrectly will lead to errors.

d. Paye Tax- the column is provided of the tax that has been deducted minus personal relief.

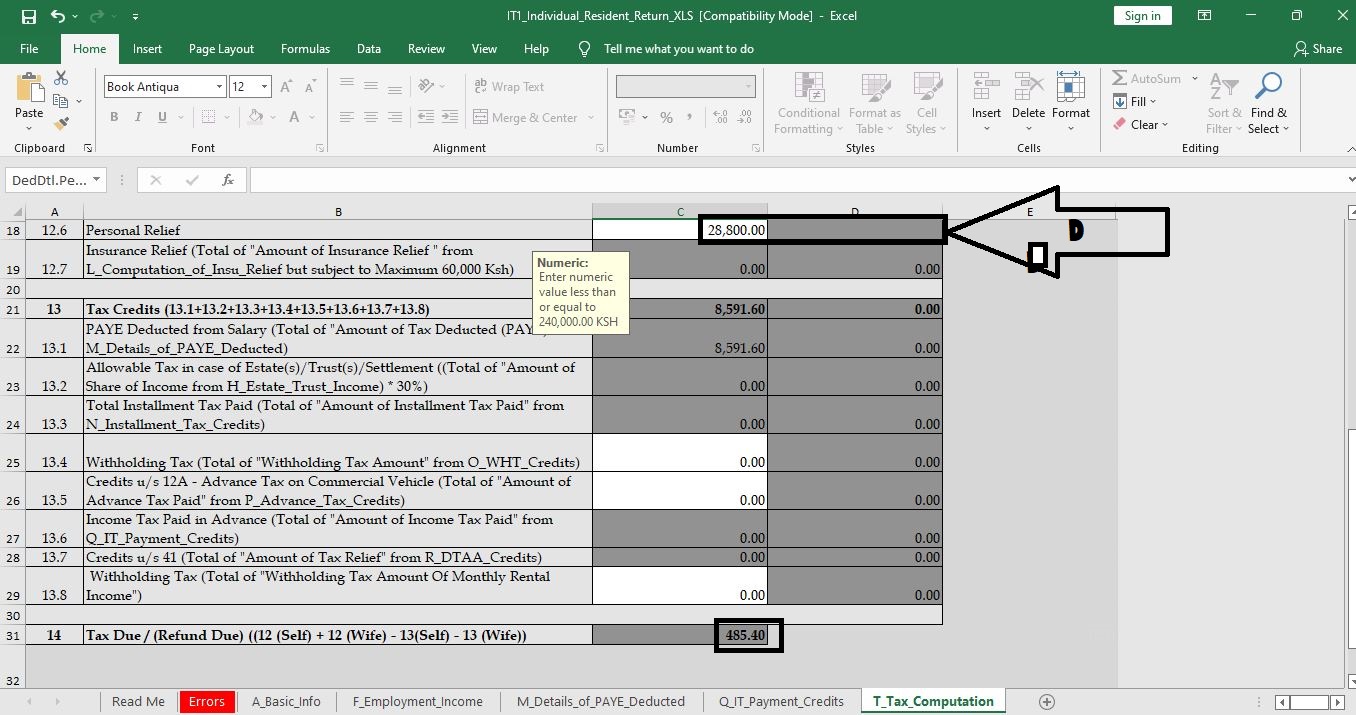

e. The personal relief is filled on the last page.

The document will calculate itself and give you a balanced sum. The total sum should be zero, but in most cases, there might be a small balance. in our case, the balance was Ksh 485. If the Balance is positive you owe KRA and if it’s Negative, KRA owes you and you should request a refund.

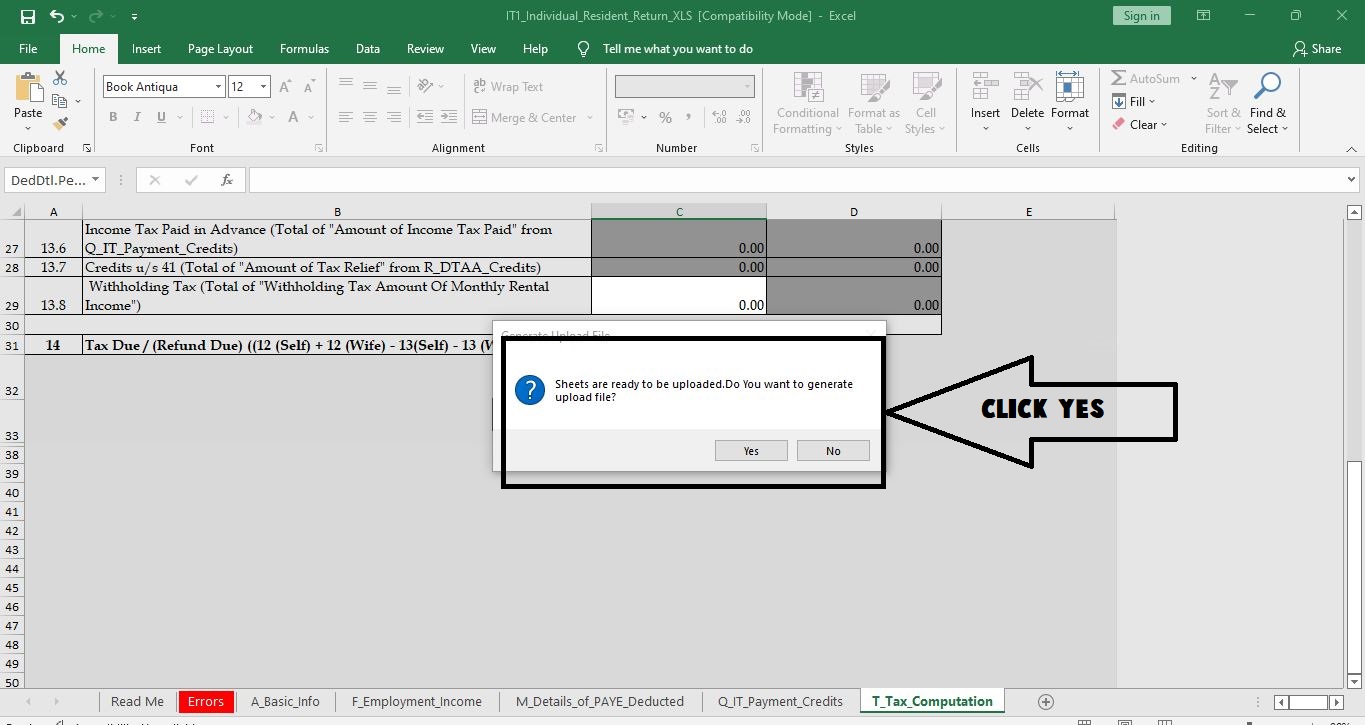

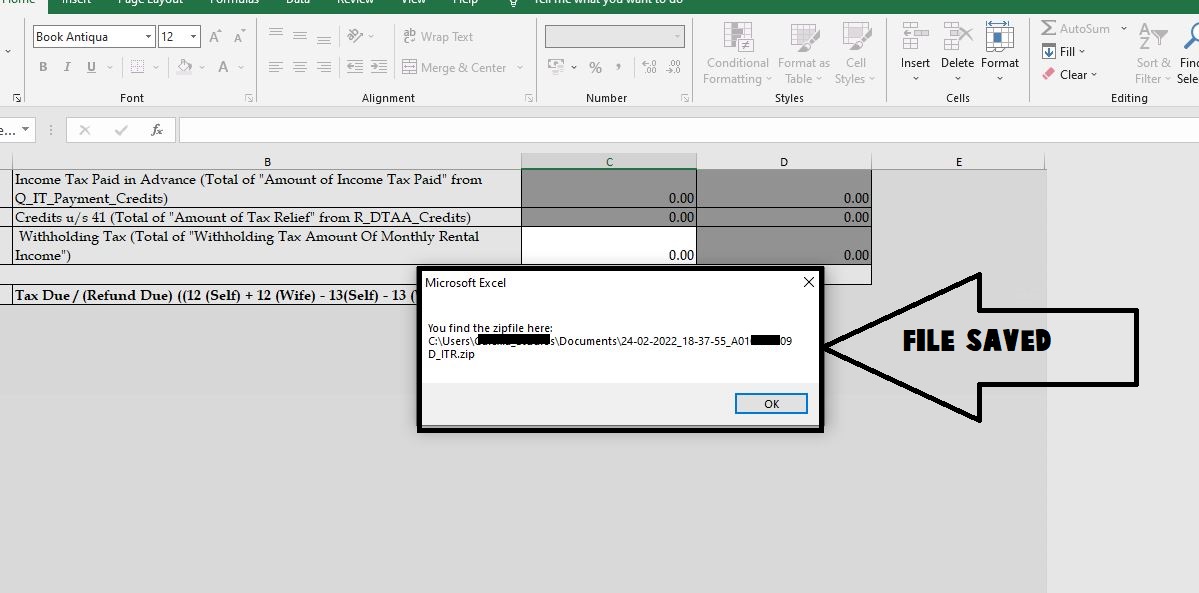

6. Complete The Document.

Sammy Irungu And Christina Shusho Releases A Kikuyu Song

Click verify or file at the bottom of your last page. if no errors were encountered. Click generate upload file as shown in the picture below. Everything at this point is all set. The file will be saved in your document folder in your P.C

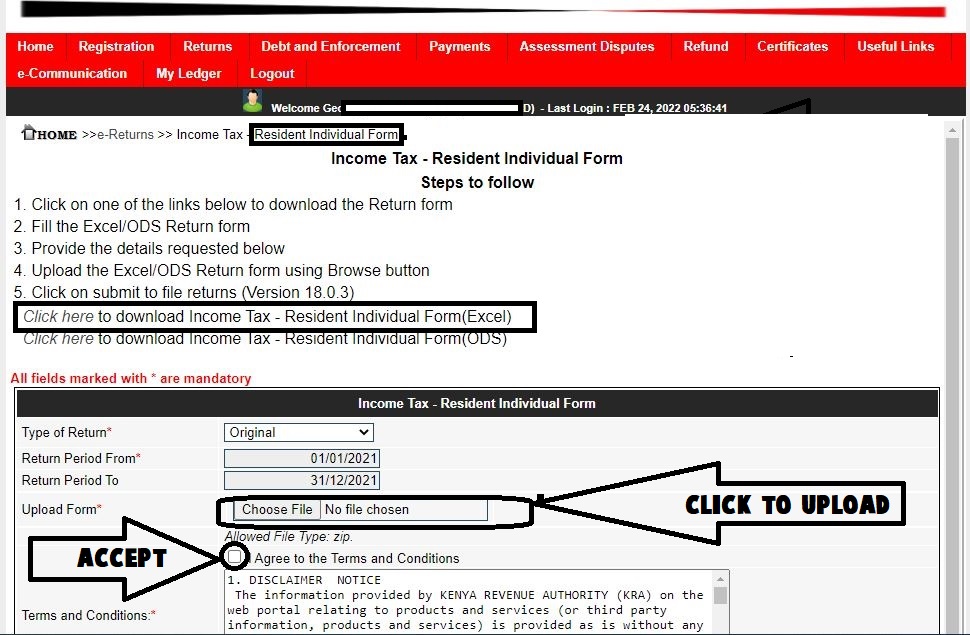

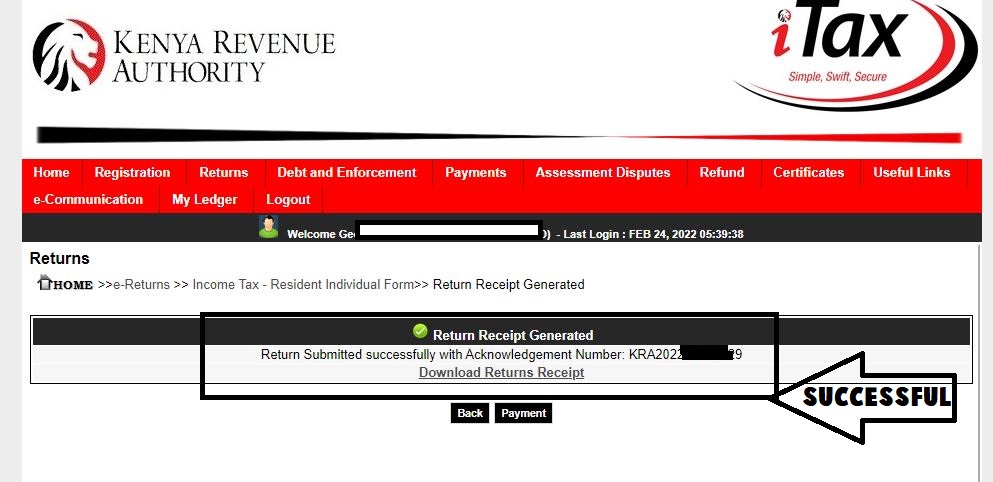

7. Upload your file.

What Am I Doing Wrong?. Tv Personality Hellen Muthoni Laments Lacking Husband

The final step is to upload your file on your KRA Itax portal in the “choose” file button. Accept the terms and conditions button and that’s it. An Acknowledgment receipt will be generated as shown below.