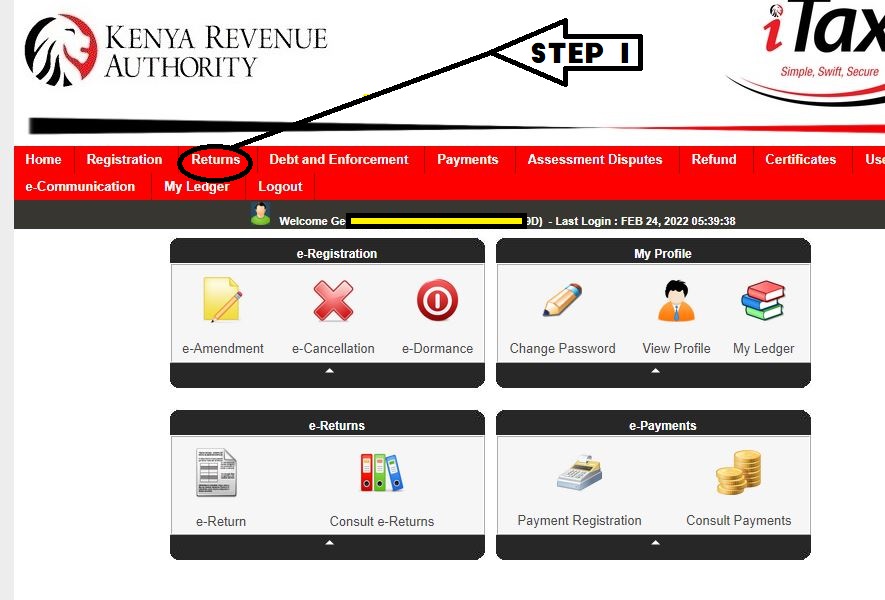

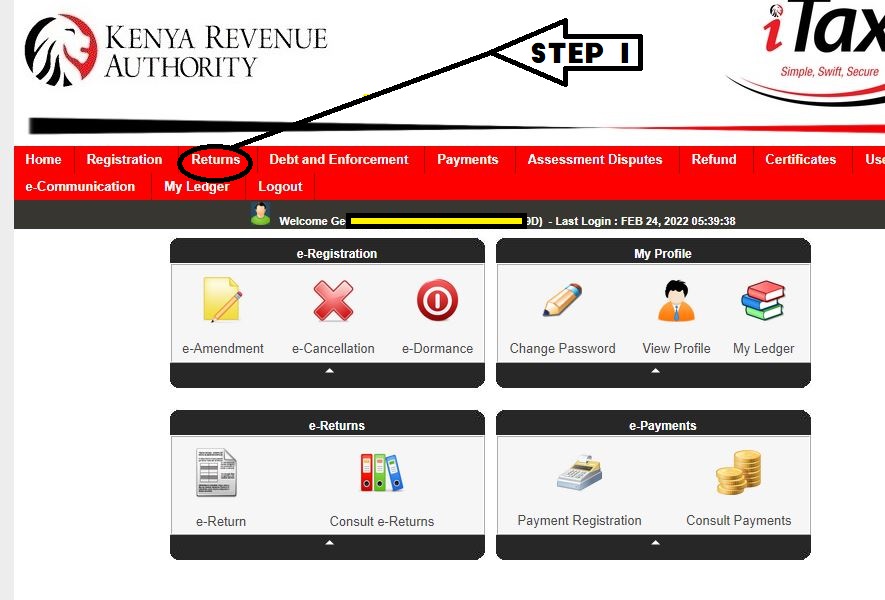

how to file Kra returns 2022. Filing tax returns has never been easy. In this article we will show you step by step how to file Kra Tax returns both PAYE and null very easy, step by step

how to file Kra returns 2022. Filing tax returns has never been easy. In this article we will show you step by step how to file Kra Tax returns both PAYE and null very easy, step by step

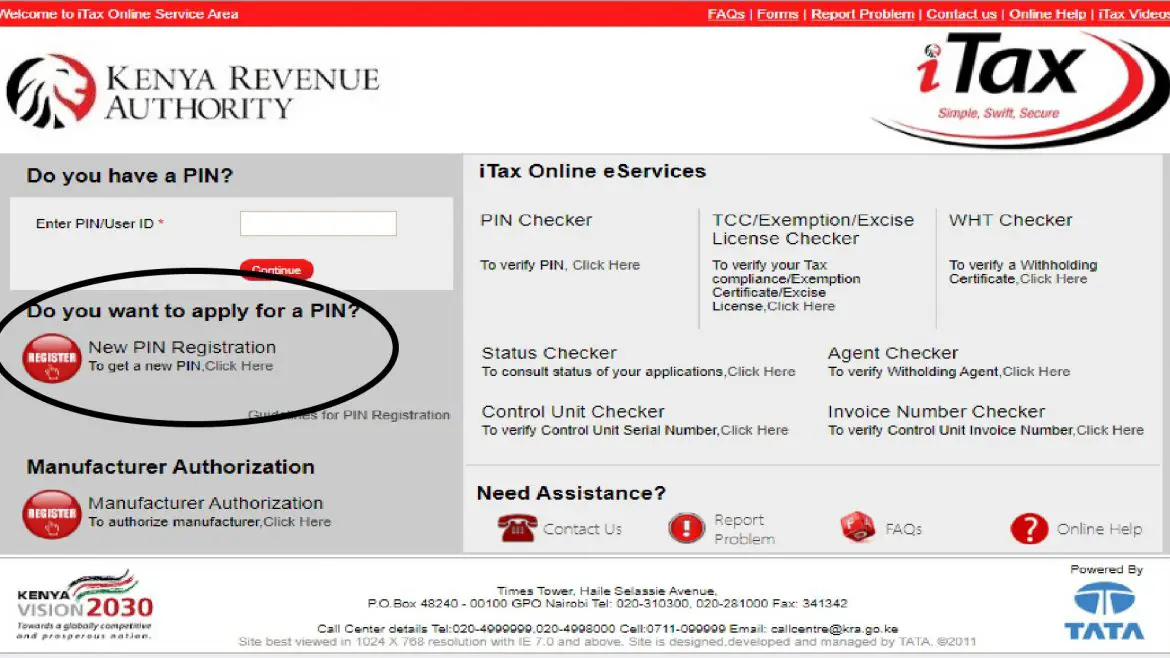

Applying for a KRA PIN in Kenya nowadays is very easy. you dont need to visit any office. All you just need is your phone all laptop and an internet connection. Below is some simple instruction for you to follow.